In the era of smartphones, saving money has never been easier, thanks to the multitude of money-saving apps available in the market. These apps help you track your spending, provide personalized savings plans and investment options, and even help you negotiate lower bills. Here are some of the best money-saving apps to help you achieve your financial goals.

Trim

Trim is a free app that helps you save money by negotiating bills on your behalf. The app connects your bank accounts and analyzes your transactions to find subscriptions and other recurring expenses.

It then helps you cancel those subscriptions or negotiate better rates for you. Trim also offers a savings feature called Trim Savings, which analyzes your spending habits and finds ways to save money on your bills, such as finding cheaper car insurance or a better cable plan.

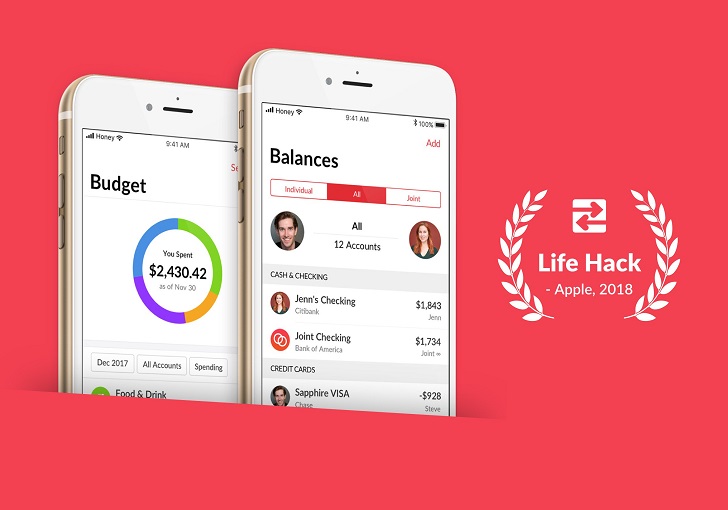

Honeydue/ Twitter | Honeydue provides access to a joint bank account in case you and your partner decide to bank together

Honeydue

Honeydue is designed for couples, allowing you to track your shared expenses and budget together. The app syncs with your bank accounts and tracks your expenses, providing a real-time view of your spending. Honeydue also offers a chat feature that allows you and your partner to communicate about your expenses and budget in real-time.

Truebill

Truebill helps you save money by canceling unused subscriptions and negotiating bills on your behalf. The app analyzes your bank statements and identifies recurring expenses, such as subscriptions and memberships, that you may not be using. Truebill then helps you cancel those subscriptions and negotiates better rates for your bills, such as cable, phone, and internet.

Paul Schrodt/ Getty | PocketGuard regards security as its number one priority, using the same 256-bit SSL protocol incorporated by banks

PocketGuard

PocketGuard is a budgeting app that helps you track your spending and savings. The app connects to your bank accounts and automatically categorizes your transactions. It also provides a monthly budget and alerts you when you're close to exceeding it. PocketGuard also offers a feature called In My Pocket, which helps you set aside money for your bills and savings goals, giving you a clear picture of your disposable income.

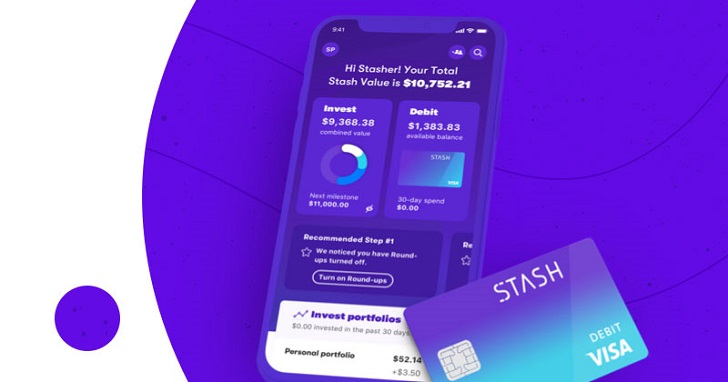

Stash

Stash is an investment app aimed at investing in stocks and ETFs, starting with as little as $5. The app offers a variety of investment options, including sustainable investing, which allows you to invest in companies that align with your values. Stash also offers Auto-Stash, which allows you to set up automatic investments regularly.

Chime

Chime is a banking app that offers a fee-free checking account and a savings account with an automatic savings feature. The app also offers early direct deposit, allowing you to access your paycheck up to two days earlier than traditional banks.

DDG/ Getty Images | Stash offers access to a banking account with no overdraft fees or minimum balance through Stride Bank

Mvelopes

M Elopes uses the envelope system to help you manage your money. The app allows you to create digital envelopes for your expenses, such as groceries, entertainment, and utilities and allocates money to each envelope. Mvelopes has a feature called Money Coaching, which helps you achieve your financial goals by providing personalized financial advice.