Building wealth is a goal that many individuals aspire to achieve. While it may seem overwhelming, it is attainable with careful planning, discipline, and a long-term perspective. This article will outline key strategies and principles to help you embark on the journey toward financial success and build lasting wealth.

Set Clear Financial Goals

The first step to building wealth is to set clear and achievable financial goals. Define your short-term, medium-term, and long-term objectives. Whether saving for a down payment on a house, funding your children's education, or securing a comfortable retirement, having well-defined goals will give you direction and motivation to stay on track.

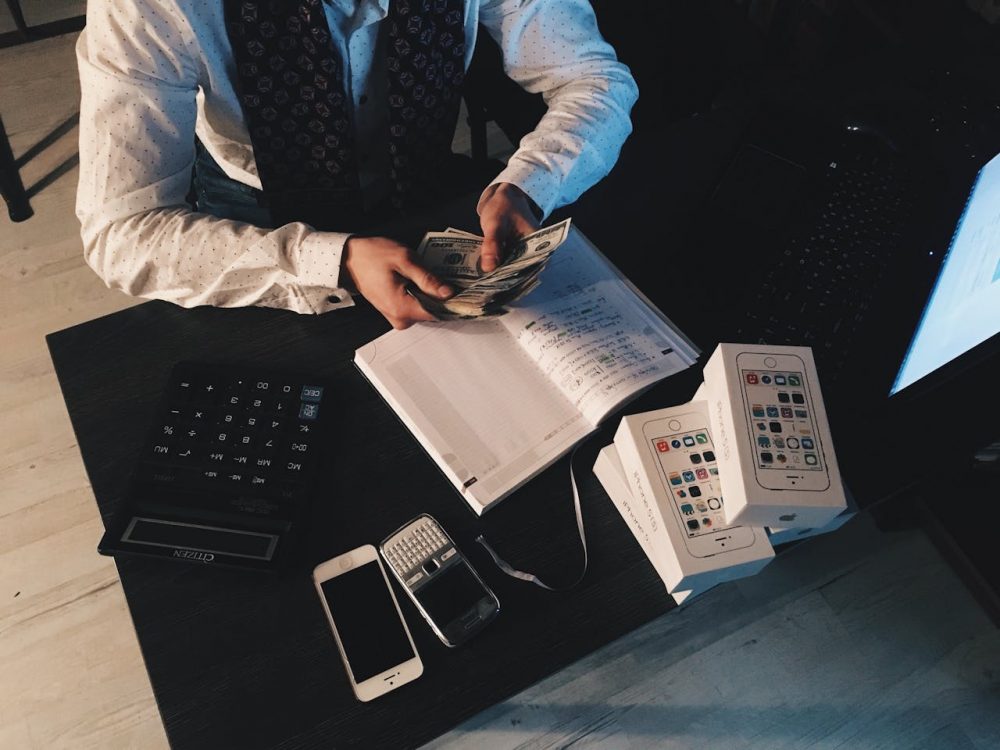

Mikhail Nilov/ Pexels | Reducing expenses is a great way to kickstart savings

Create a Budget and Stick To It

A budget is a fundamental tool for managing your finances effectively. Create a comprehensive budget that includes your income, expenses, savings, and investments. Track your spending and identify areas where you can cut unnecessary expenses. Sticking to a budget will help you save money and allocate it towards your wealth-building goals.

Build an Emergency Fund

Life is unpredictable, and unexpected expenses can arise at any time. Having an emergency fund is crucial to protecting your wealth-building efforts. Aim to save at least three to six months' living expenses in a readily accessible account. This fund will act as a safety net during financial emergencies, preventing you from derailing your long-term plans.

Pay Off High-Interest Debt

High-interest debt, such as credit card debt, can significantly hinder building wealth. Prioritize paying off these debts quickly to avoid accumulating unnecessary interest charges. Consider using the debt snowball or debt avalanche method to tackle multiple debts systematically.

Tima Miroshnichenko/ Pexels | The more you learn, the more you earn

Invest Wisely

Investing is a key component of wealth-building, allowing your money to work for you. Diversify your investments across different asset classes, such as stocks, bonds, real estate, and mutual funds. Consider consulting a financial advisor to create an investment plan tailored to your risk tolerance and financial goals.

Maximize Retirement Contributions

Contributing to retirement accounts, such as 401(k)s or IRAs, is essential for building wealth over the long term. These accounts offer tax advantages and compound growth, allowing your savings to grow significantly. Take advantage of any employer-matching contributions and consistently contribute as much as you can afford.

Educate Yourself About Personal Finance

Financial literacy is a crucial aspect of building wealth. Educate yourself about personal finance, investment strategies, and money management principles. Read books, attend seminars, and follow reputable financial experts to expand your knowledge and make informed decisions.

Liza Summer/ Pexels | Wealth is not about having a lot of money; it's about having a lot of options

Continuously Increase Your Income

While managing expenses is important, increasing your income is equally vital to building wealth. Look for opportunities to grow your career, acquire new skills, or explore additional income streams, such as starting a side business or investing in rental properties. The more you earn, the more you can save and invest towards your financial goals.

Review and Adjust Your Plan Regularly

Building wealth is a dynamic process that requires ongoing evaluation and adjustment. Regularly review your financial plan, track your progress towards your goals, and make necessary changes to stay on course. Life events and market fluctuations may impact your strategy, so remain flexible and adapt as needed.